5 Military Pay Tips

Introduction to Military Pay

Military pay can be complex and overwhelming, especially for new recruits or those transitioning out of the military. Understanding how military pay works and how to manage it effectively is crucial for financial stability and security. In this article, we will explore five military pay tips to help service members make the most of their compensation package.

Understanding Military Pay

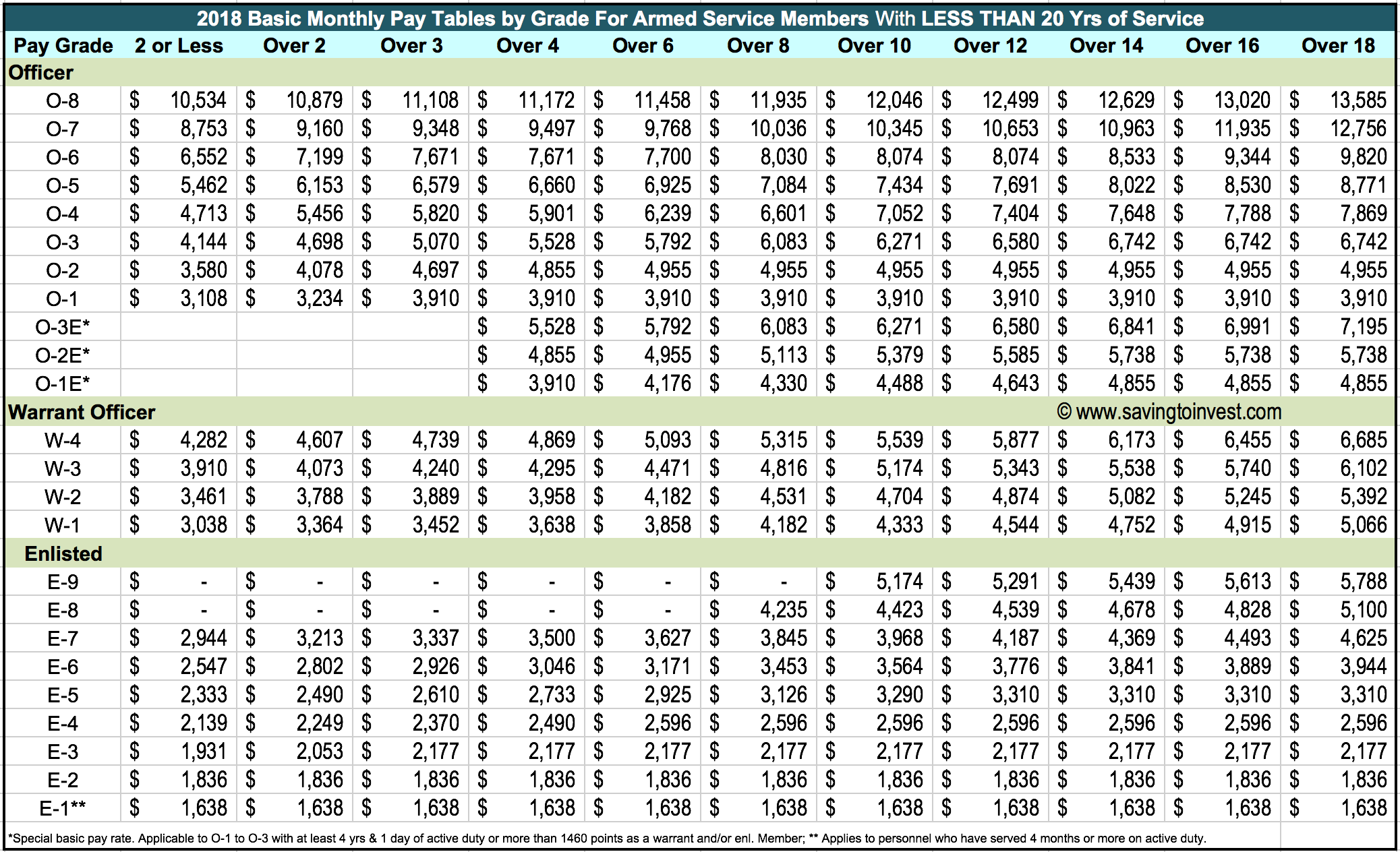

Before we dive into the tips, it’s essential to understand the basics of military pay. Military pay is based on a combination of factors, including rank, time in service, and job specialty. The pay scale is divided into two main categories: basic pay and special pay. Basic pay is the standard salary for all service members, while special pay includes allowances and bonuses for specific duties or circumstances. Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are two examples of special pay that can significantly impact a service member’s take-home pay.

Military Pay Tip 1: Take Advantage of Tax-Free Allowances

One of the most significant benefits of military pay is the tax-free allowances. BAH and BAS are not subject to federal income tax, which means that service members can keep more of their hard-earned money. To take advantage of these allowances, service members should carefully review their pay stubs to ensure they are receiving the correct amount. They should also consider using these allowances to pay for necessities like housing and food, rather than relying on their basic pay.

Military Pay Tip 2: Max Out Your Thrift Savings Plan (TSP)

The Thrift Savings Plan (TSP) is a retirement savings plan offered to federal employees, including service members. The TSP offers a range of investment options and matching contributions from the government. Service members should aim to contribute at least 5% of their basic pay to the TSP to maximize the matching contributions. This will help them build a significant nest egg for retirement and reduce their taxable income.

Military Pay Tip 3: Use the Military’s Special Pay and Bonuses

The military offers a range of special pay and bonuses for specific duties or circumstances. For example, Hazardous Duty Pay is available for service members who work in hazardous conditions, while Special Duty Pay is available for those who take on additional responsibilities. Service members should research the special pay and bonuses available to them and apply for them if eligible. This can significantly boost their take-home pay and provide additional financial security.

Military Pay Tip 4: Manage Your Debt Effectively

Debt can be a significant challenge for service members, especially those with limited financial experience. To manage debt effectively, service members should: * Create a budget that accounts for all their expenses * Prioritize their debts, focusing on high-interest loans first * Consider consolidating their debt into a lower-interest loan * Take advantage of the military’s debt counseling services

By managing their debt effectively, service members can reduce their financial stress and free up more money in their budget for savings and investments.

Military Pay Tip 5: Plan for Transition

Transitioning out of the military can be a challenging and uncertain time, especially when it comes to finances. To plan for transition effectively, service members should: * Start saving for transition at least a year in advance * Research the job market and required skills for their desired career * Consider pursuing additional education or training to boost their employability * Take advantage of the military’s transition assistance programs, such as the Transition Assistance Program (TAP)

By planning for transition carefully, service members can reduce their financial stress and set themselves up for success in their civilian careers.

💡 Note: Service members should always review their pay stubs carefully to ensure they are receiving the correct amount of pay and allowances.

In summary, military pay can be complex, but with the right knowledge and strategies, service members can make the most of their compensation package. By taking advantage of tax-free allowances, maxing out their TSP, using special pay and bonuses, managing debt effectively, and planning for transition, service members can achieve financial stability and security. With careful planning and management, service members can build a bright financial future, both in and out of the military.

What is the difference between basic pay and special pay?

+

Basic pay is the standard salary for all service members, while special pay includes allowances and bonuses for specific duties or circumstances.

How do I maximize my Thrift Savings Plan (TSP) contributions?

+

To maximize your TSP contributions, aim to contribute at least 5% of your basic pay to the TSP to maximize the matching contributions from the government.

What resources are available to help service members manage their debt?

+

The military offers a range of resources to help service members manage their debt, including debt counseling services and financial planning tools.