5 Ways Calculate Pay

Introduction to Calculating Pay

Calculating pay can be a complex process, especially when considering various factors such as hours worked, pay rates, and benefits. In this article, we will explore five common methods for calculating pay, including hourly, salary, commission, piecework, and overtime pay. Understanding these methods can help employees, employers, and payroll professionals accurately calculate pay and avoid disputes.

Hourly Pay Calculation

Hourly pay is one of the most common methods of calculating pay. To calculate hourly pay, you need to know the number of hours worked and the hourly rate. The formula for calculating hourly pay is: Hourly Pay = Number of Hours Worked x Hourly Rate For example, if an employee works 40 hours a week at an hourly rate of 15 per hour, their weekly pay would be: 40 hours x 15 per hour = $600 per week It’s essential to consider factors such as overtime pay, break times, and holidays when calculating hourly pay.

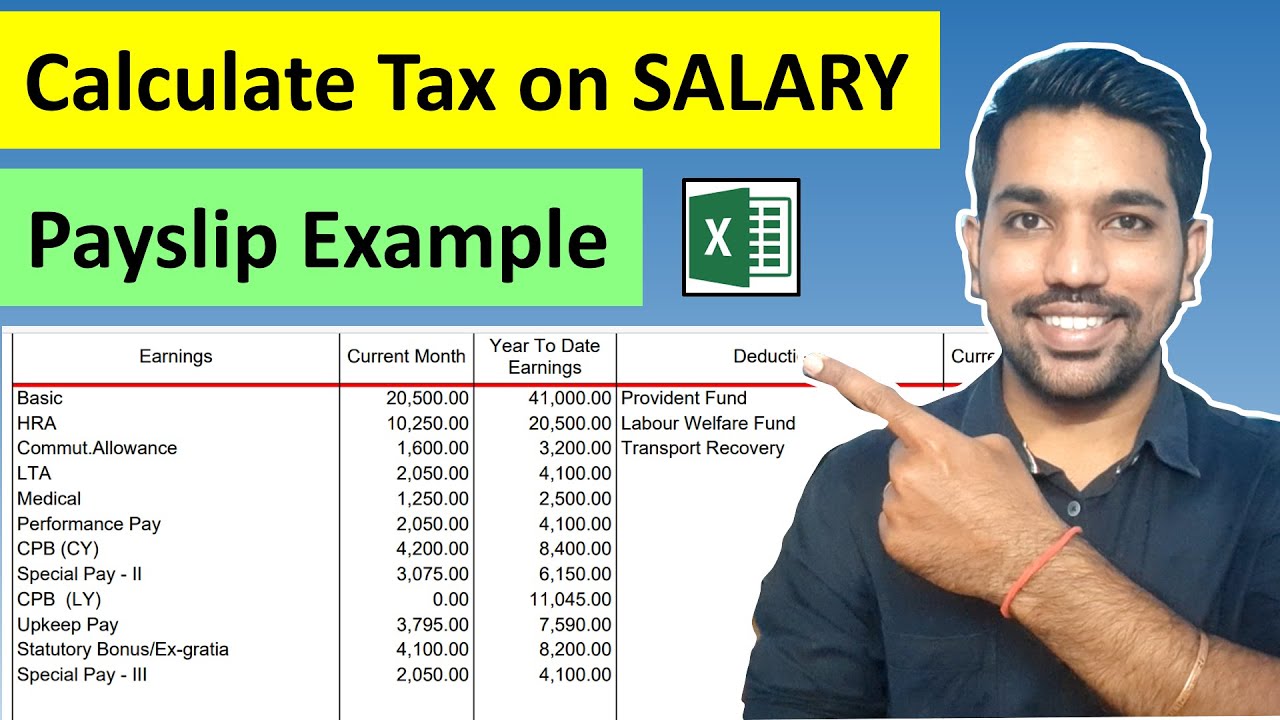

Salary Pay Calculation

Salary pay is another common method of calculating pay. To calculate salary pay, you need to know the annual salary and the pay frequency. The formula for calculating salary pay is: Salary Pay = Annual Salary / Pay Frequency For example, if an employee has an annual salary of 60,000 and is paid bi-weekly, their bi-weekly pay would be: 60,000 per year / 26 pay periods per year = $2,307 per pay period It’s crucial to consider factors such as benefits, bonuses, and tax deductions when calculating salary pay.

Commission Pay Calculation

Commission pay is a performance-based method of calculating pay. To calculate commission pay, you need to know the sales amount and the commission rate. The formula for calculating commission pay is: Commission Pay = Sales Amount x Commission Rate For example, if an employee sells 10,000 worth of products and has a commission rate of 10%, their commission pay would be: 10,000 x 10% = $1,000 It’s essential to consider factors such as sales targets, commission structures, and pay schedules when calculating commission pay.

Piecework Pay Calculation

Piecework pay is a method of calculating pay based on the number of units produced. To calculate piecework pay, you need to know the number of units produced and the price per unit. The formula for calculating piecework pay is: Piecework Pay = Number of Units Produced x Price per Unit For example, if an employee produces 100 units and has a price per unit of 5, their piecework pay would be: 100 units x 5 per unit = $500 It’s crucial to consider factors such as production targets, quality standards, and pay rates when calculating piecework pay.

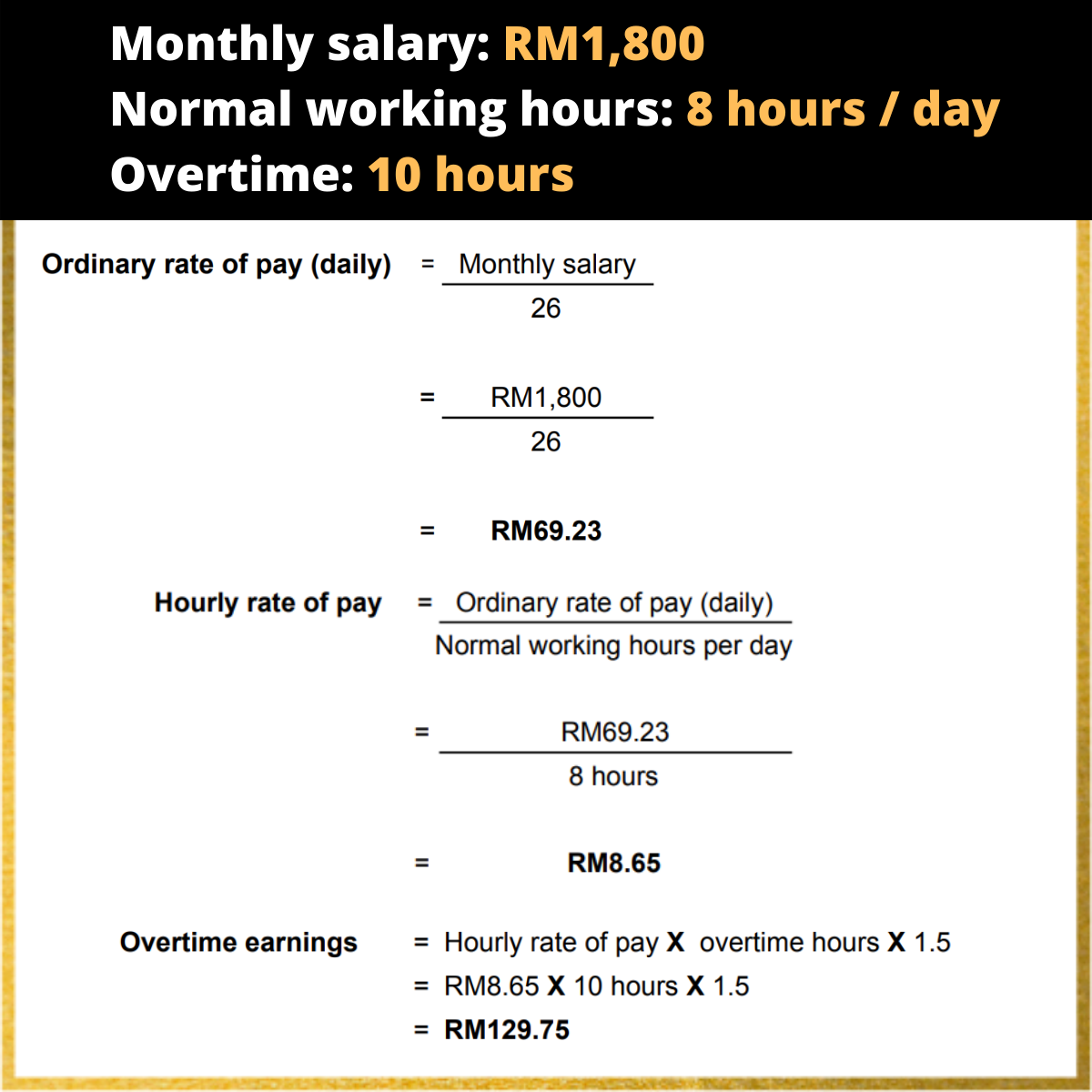

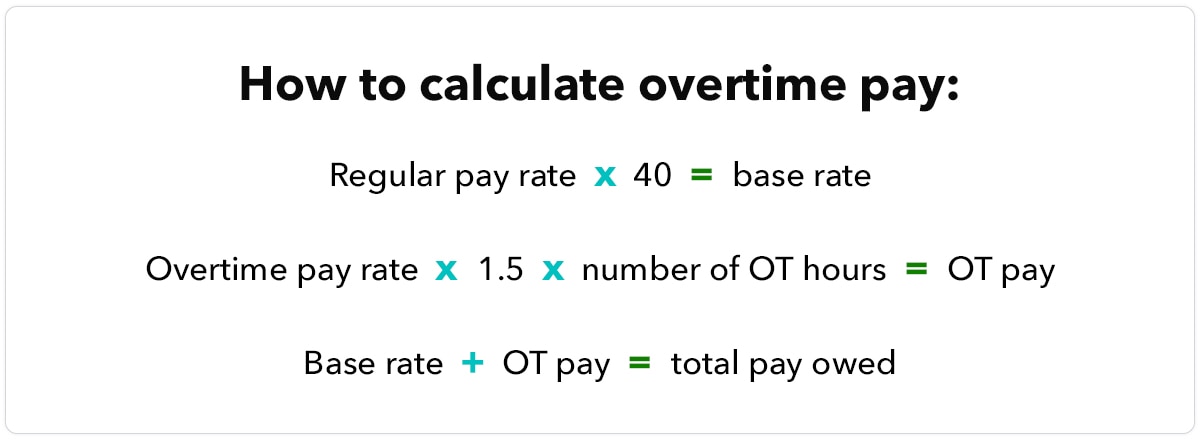

Overtime Pay Calculation

Overtime pay is a method of calculating pay for hours worked beyond the standard working hours. To calculate overtime pay, you need to know the number of overtime hours worked and the overtime rate. The formula for calculating overtime pay is: Overtime Pay = Number of Overtime Hours Worked x Overtime Rate For example, if an employee works 10 overtime hours at an overtime rate of 20 per hour, their overtime pay would be: 10 hours x 20 per hour = $200 It’s essential to consider factors such as overtime policies, pay schedules, and benefits when calculating overtime pay.

💡 Note: When calculating pay, it's essential to consider various factors, including taxes, benefits, and deductions, to ensure accurate and fair pay.

In summary, calculating pay can be a complex process, and understanding the different methods can help employees, employers, and payroll professionals accurately calculate pay. By considering factors such as hours worked, pay rates, and benefits, you can ensure fair and accurate pay.

The key points to remember are: * Hourly pay is calculated based on the number of hours worked and the hourly rate. * Salary pay is calculated based on the annual salary and pay frequency. * Commission pay is calculated based on the sales amount and commission rate. * Piecework pay is calculated based on the number of units produced and the price per unit. * Overtime pay is calculated based on the number of overtime hours worked and the overtime rate.

What is the most common method of calculating pay?

+

The most common method of calculating pay is hourly pay, which is based on the number of hours worked and the hourly rate.

How is commission pay calculated?

+

Commission pay is calculated based on the sales amount and the commission rate. The formula for calculating commission pay is: Commission Pay = Sales Amount x Commission Rate.

What is the difference between salary pay and hourly pay?

+

Salary pay is based on an annual salary and pay frequency, while hourly pay is based on the number of hours worked and the hourly rate. Salary pay is typically used for exempt employees, while hourly pay is used for non-exempt employees.