5 Ways Army Pay Works

Introduction to Army Pay

Joining the army is a significant decision that affects not only the individual but also their family. One of the crucial aspects to consider is the compensation package, which includes basic pay, allowances, and special pays. Understanding how army pay works is essential for managing finances effectively and making informed decisions about one’s military career. In this article, we will delve into the intricacies of army pay, exploring the different components and how they are calculated.

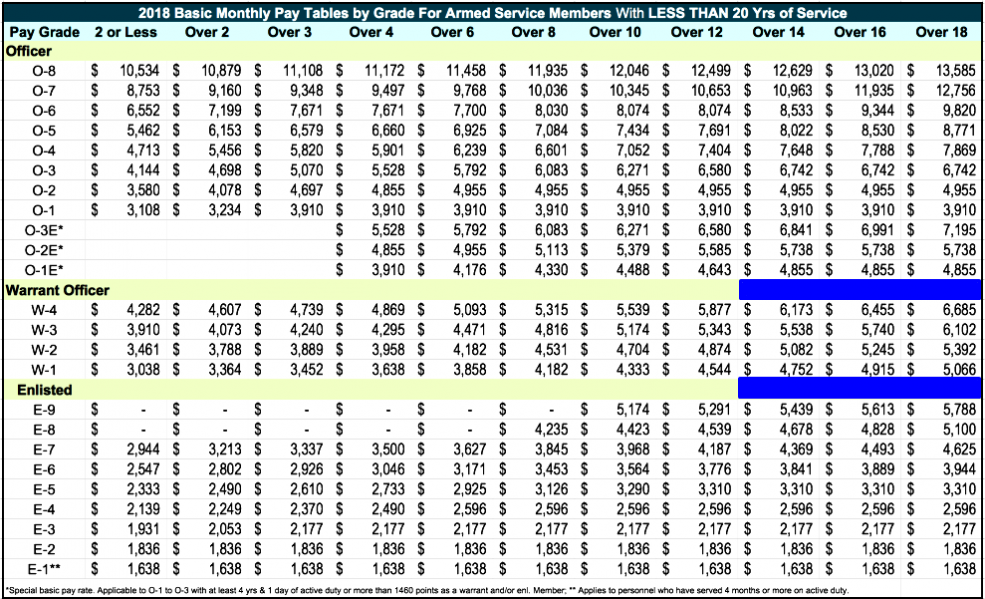

Basic Pay

Basic pay is the fundamental component of army compensation, and it is determined by the individual’s rank and time in service. The military uses a pay scale to calculate basic pay, with higher ranks and longer service times resulting in higher pay. The pay scale is divided into two categories: enlisted and officer. Enlisted personnel include ranks from Private to Sergeant Major, while officer ranks range from Second Lieutenant to General. Basic pay is paid twice a month, on the 1st and 15th of each month.

Allowances

Allowances are an essential part of army pay, as they help offset the costs of living expenses, such as housing, food, and clothing. There are several types of allowances, including: * Bachelor Housing Allowance (BAH): paid to personnel who do not live in government quarters * Basic Allowance for Subsistence (BAS): paid to personnel to help cover food expenses * Clothing Allowance: paid to personnel to help cover the cost of uniforms and other clothing items * Family Separation Allowance: paid to personnel who are separated from their families due to military duties

Special Pays

Special pays are additional forms of compensation that are paid to personnel who perform specific duties or have unique skills. Some examples of special pays include: * Jump Pay: paid to personnel who are qualified parachutists * Dive Pay: paid to personnel who are qualified divers * Flight Pay: paid to personnel who are qualified aviators * Special Duty Pay: paid to personnel who perform duties that are considered particularly challenging or hazardous

Calculation of Army Pay

The calculation of army pay involves several factors, including basic pay, allowances, and special pays. The total pay is calculated by adding the basic pay and allowances, and then adding any special pays that the individual is eligible for. The following table provides an example of how army pay might be calculated:

| Component | Amount |

|---|---|

| Basic Pay | $3,000 |

| Bachelor Housing Allowance (BAH) | $1,500 |

| Basic Allowance for Subsistence (BAS) | $300 |

| Jump Pay | $250 |

| Total Pay | $5,050 |

📝 Note: The amounts listed in the table are examples and may not reflect actual pay rates.

Taxation of Army Pay

Army pay is subject to federal income tax, but some components of pay are exempt from taxation. For example, basic allowance for housing and basic allowance for subsistence are not subject to taxation. However, basic pay and special pays are taxable. It is essential for military personnel to understand their tax obligations and plan accordingly to avoid any tax-related issues.

In summary, army pay is a complex system that involves several components, including basic pay, allowances, and special pays. Understanding how these components work together is crucial for managing finances effectively and making informed decisions about one’s military career. By grasping the intricacies of army pay, military personnel can better plan for their future and make the most of their compensation package.

How is basic pay calculated in the army?

+

Basic pay is calculated based on the individual’s rank and time in service, using a pay scale that is divided into two categories: enlisted and officer.

What are some examples of special pays in the army?

+

Some examples of special pays include jump pay, dive pay, flight pay, and special duty pay, which are paid to personnel who perform specific duties or have unique skills.

Are all components of army pay subject to taxation?

+

No, not all components of army pay are subject to taxation. For example, basic allowance for housing and basic allowance for subsistence are not taxable, while basic pay and special pays are taxable.